The Only Guide for Lemonade: Insurance Built For The 21st Century

0-star customer rating and also just under 3,000 complaints filed in the last 3 years (affordable). This number of grievances may appear high, however it represents a small fraction of consumers when you take into account the fact that Geico is the second-largest automobile insurance policy service provider in the united state as well as Progressive is the third-largest, according to the National Organization of Insurance Policy Commissioners (NAIC).

Geico often tends to supply lower prices for many policyholders and has a little higher consumer fulfillment ratings, while Progressive has fantastic options for high-risk motorists and also even more commonly available usage-based insurance. Generally, here's just how we rate Geico vs (cheaper cars). Progressive: Other referrals for auto insurance coverage Geico as well as Progressive aren't your just excellent options for inexpensive automobile insurance.

cars business insurance cheapest car insurance cheaper

cars business insurance cheapest car insurance cheaper

We advise State Farm for student vehicle drivers based on its discount offerings. The Drive Safe & Save, TM and also Steer Clear programs both assist young chauffeurs conserve on insurance coverage costs (money). Of program, State Farm isn't just for young chauffeurs.

Power United State Car Insurance Policy Complete Satisfaction Study (auto insurance). It additionally has several of the most affordable prices on average. Nevertheless, protection is not readily available to every person. To be eligible for an automobile insurance coverage plan with USAA, you have to be a participant of the army or have a family members participant that is a USAA member.

Top Guidelines Of Determining Auto Insurance Rates - Geico

car affordable car insurance affordable car insurance liability

car affordable car insurance affordable car insurance liability

Our methodology Since consumers depend on us to give unbiased and also precise information, we created a comprehensive rating system to formulate our positions of the very best auto insurance policy companies. We gathered information on dozens of automobile insurance policy service providers to quality the business on a vast array of ranking aspects. Completion result was a general rating for each provider, with the insurance providers that scored the most factors topping the listing - prices.

car insured suvs trucks cheapest auto insurance

car insured suvs trucks cheapest auto insurance

insurance prices cars auto insurance

insurance prices cars auto insurance

Insurance coverage (20% of overall score): Companies that use a variety of selections for insurance protection are more probable to fulfill customer demands. Reputation (20% of overall rating): Our study team thought about market share, rankings from industry specialists and also years in business when offering this score (risks). Accessibility (20% of complete rating): Vehicle insurance provider with greater state schedule and few eligibility demands racked up highest in this classification.

There are thousands of Geico insurance coverage reviews uploaded online. Is Geico a reputable insurance firm?

Find out why in this short article, where we have a look at Geico vehicle insurance policy protection choices, prices, benefits, and assesses from policyholders. Geico Car Insurance Coverage Score: 4. 6 Stars We price Geico 4. 6 out of 5. 0 celebrities and also name it Click for more the Best Overall in 2022. The insurance provider's affordable rates and easy insurance claims process make it a clever choice for the majority of drivers.

Geico Car Buying Service - Questions

accident low cost prices accident

accident low cost prices accident

We also evaluated 1,000 vehicle insurance coverage consumers on a selection of subjects. In general, 36 percent of Geico consumers believe they experienced a price increase without an obvious cause. This is reduced than the average of 41 percent for all companies. Most states permit auto insurance provider to utilize credit history profiles in calculating rates. cheap auto insurance.

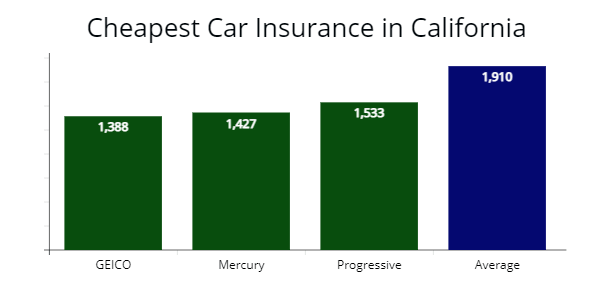

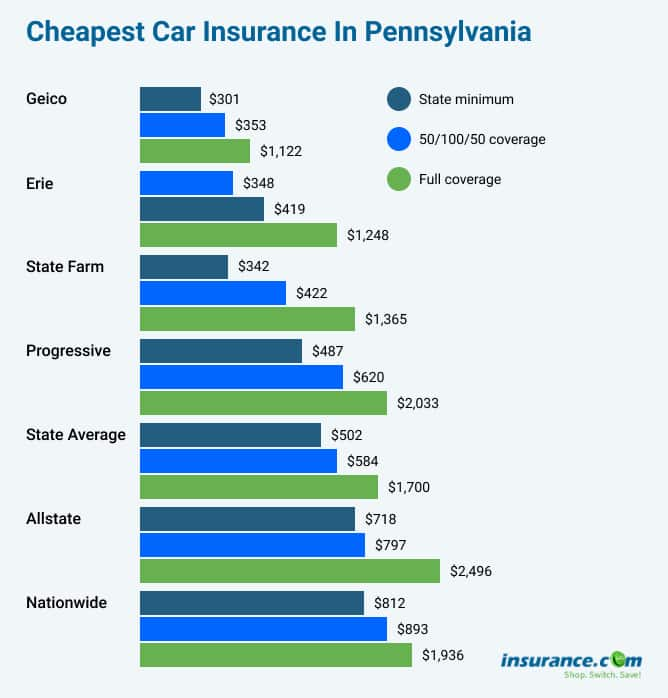

What you spend for car insurance coverage from Geico depends on your location. auto. Chauffeurs in some states might pay just $1,000 per year, while others might pay $2,000 or more for complete coverage insurance policy based upon area alone. Below's an overview of Geico's insurance policy costs by state, in addition to each state's ordinary according to our rate price quotes.

It consists of jump-starts, extra tire installation, lugging to a repair service shop, as well as lockout solutions as much as $100. Rental car repayment This protection pays for the costs of a rental auto while your car is being repaired after a covered insurance claim. Geico deals with Business Rent-A-Car, which indicates your insurance coverage will pay Enterprise directly (car insurance).

In the J.D - cheaper car. Power 2021 U.S. Auto Insurance Coverage Research Study, SM, Geico earned a complete satisfaction ranking over the regional standard in California and also the Central and also New England areas - automobile. There are lots of positive Geico insurance policy reviews on websites including Trustpilot as well as the BBB. On the BBB web site, Geico has an A+ ranking, showing that it quickly replies to customer grievances.

The 10-Second Trick For Insurance For Lyft Drivers

This put Geico in the top five companies by contentment level. In favorable Geico insurance coverage reviews, customers praise the simplicity of communication with the company's reps. "I have actually made use of Geico for the last [seven] years, as well as they have done a wonderful work for me. No concerns with insurance claims. No responsive rate hikes after insurance claims.

https://www.youtube.com/embed/JdYwDLvz6Fg

They help every time I call and also are constantly so friendly. I am proud to call them my insurance coverage company. You may save cash with Geico, however you waste a whole lot of time.