My liability car insurance blog 6313

Some Known Factual Statements About How To Lower Your Home And Auto Insurance Rates - Ksat.com

That makes you a lower threat to guarantee and validates a lower premium. You might consider telling your company that the premium you've paid is expensive based on the truth that you were barely driving. Another comparable technique might be to at request an adjustment in the quantity of mileage that's factored into a premium.

Think about a suspension if you have numerous lorries If you have multiple cars on your policy and you're not driving among them, among the other great ways to lower cars and truck insurance is to ask for suspension of protection for vehicle (money). For instance, if you and your partner have 2 automobiles however are no longer commuting, consider suspension for one car.

It's one of the major ways to conserve on insurance premiums (cheapest). Shop around occasionally For lots of individuals, there might easily be a half dozen or more automobile insurance providers in your area.

You may be getting a less expensive rate but have a much larger deductible, or be getting some other benefit change. Ensure you understand if you are being provided lower vehicle insurance coverage with the exact same protection or various protection. Ask questions and check out the policy details. 4 (vehicle). Ask about other discounts Once you have actually compared rates, examine around for more discount rates.

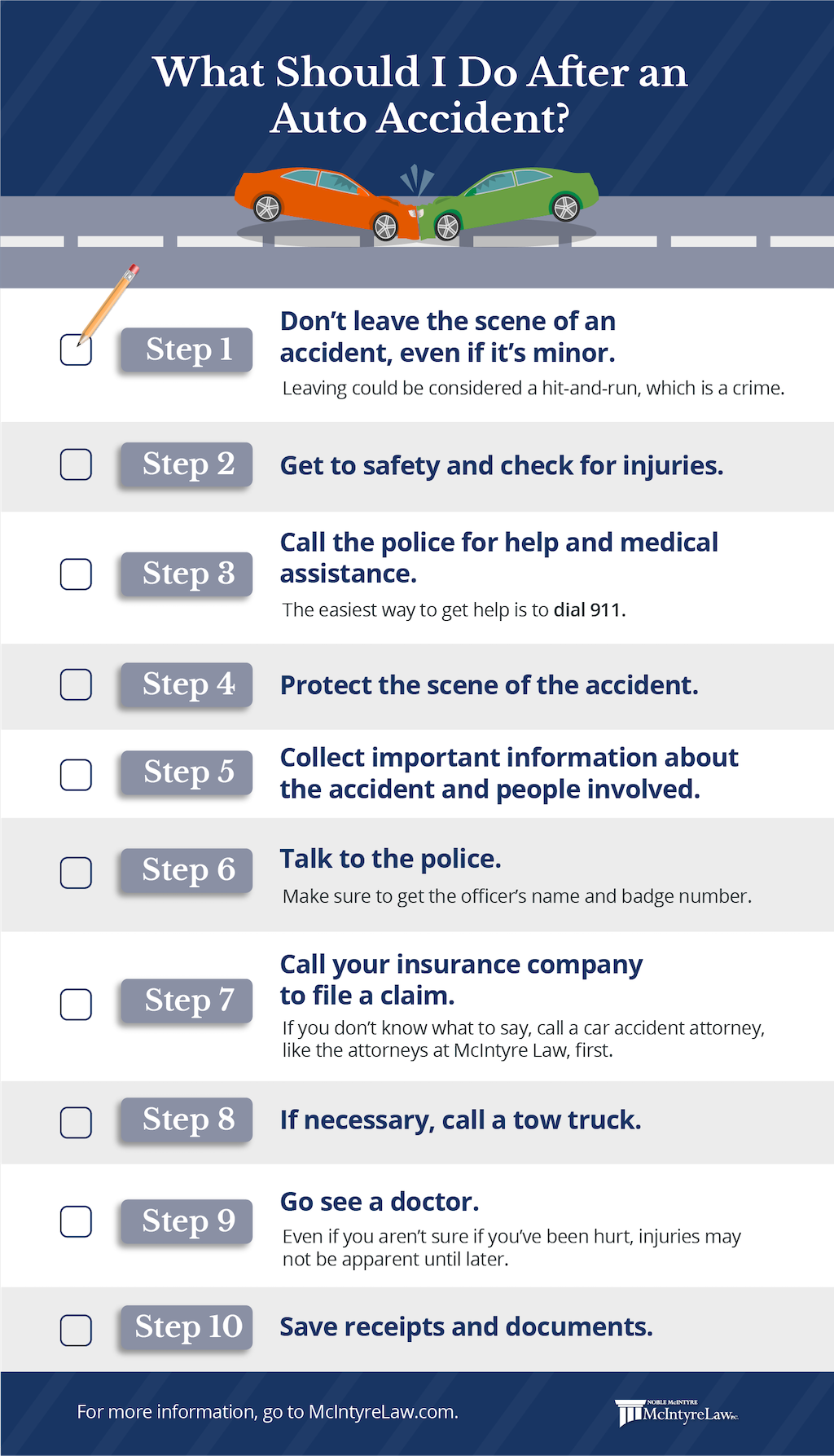

How to decrease cars and truck insurance after a mishap or ticket (auto). Here's some methods you can put any premium increases in reverse after you've been involved in a vehicle accident. How To Lower Automobile Insurance After A Mishap Or Ticket Maybe you skidded out on a patch of sand and slammed into a pole.

Some automobile insurance providers comprehend this and accept it. They are prepared to ignore the first mishap a driver has and won't increase your premiums.

Take a Driving Course Taking a driving course could reduce your premiums after an accident or a ticket. Your insurer may view it as you are taking an interest in enhancing your driving abilities. If they do, they might be ready to reduce your rate when it comes time to renew your policy.

Little Known Questions About How To Reduce The Cost Of Car Insurance - Carinsurance.org.

This is an excellent method how to lower vehicle insurance coverage after an accident or ticket. Nix Collision Protection Among the most reliable ways to minimize your cars and truck insurance coverage premiums after a ticket or an accident - or any other time - is by getting rid of your accident protection.

Prior to you choose on this alternative, make sure you determine if you are able to shell out more money in the occasion that you do get into an accident in the future. Inquire about Discounts A lot of automobile insurers offer discount rates to their policy holders. Some car insurance coverage discounts that might be readily available to you include low mileage driving (you drive less than 5,000 miles a year) and a devoted customer discount.

That's not necessarily the case. Do some research to find out if there is another provider who is ready to provide you a lower premium, despite your mishap or ticket. Keep in mind that automobile insurance provider are eager to draw in brand-new customers, and one method they can do that is by using the best cost possible.

The more contrasts you make, the better chance you'll have of conserving cash. Each insurer has its own formula for calculating automobile insurance rates. They position various levels of significance on such aspects as the type of vehicle you drive, annual mileage, your age, your gender, and where you garage your vehicle(s).

Extensive defense pays to fix vehicle damage from mishaps other than accidents, such as vandalism or fire. If you want this type of protection, you need to purchase a policy that includes this protection. You'll miss a chance to cut car insurance costs if you don't ask about discounts (cars).

If you have a low credit rating with the three major credit bureaus Equifax, Experian and Trans, Union you may be punished. Many insurers rely on credit bureau information when developing their own credit-based insurance coverage scores for customers. A great way to improve your credit history is to pay your bills on time. cheaper cars.

Review your credit reports carefully to make sure they do not consist of errors. Be mindful that not all states allow insurers to utilize credit details to determine cars and truck insurance coverage rates. According to the Insurance Coverage Details Institute, mentions that limit making use of credit report in car insurance coverage rates consist of California, Hawaii, and Massachusetts.

The Greatest Guide To 10 Tips To Lower Your Car Insurance Costs – Forbes Advisor

Some aspects to think about before buying a hybrid vehicle include whether to purchase utilized and if you will certify for insurance discount rates. There are many factors to consider when adding another automobile to your car insurance.

Car insurance coverage is a pricey and mostly unavoidable element to owning a vehicle. Some of the factors coverage is so pricey are things you can't easily alter, like your age and where you live. Other factors, though, are within your control. Making the best choices on them might help you save.

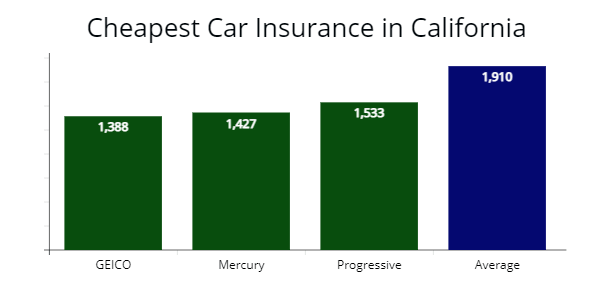

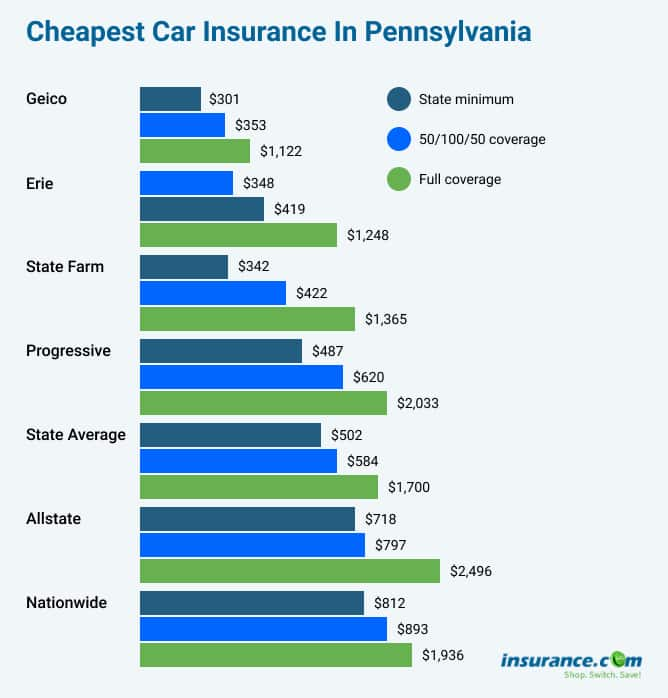

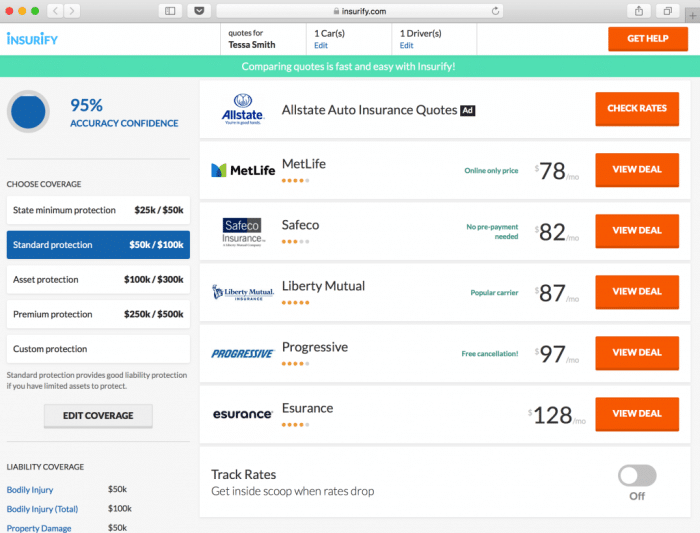

1. Get several quotes Among the very best methods to minimize car insurance is to compare quotes from multiple insurer. In a 2019 survey by Customer Reports publication, two thirds of readers who got 3 or more insurance quotes conserved money on their premiums. vehicle insurance. You can look around for the best car insurance coverage by directly getting in touch with insurer either online or over the phone.

It can also be valuable to ask loved ones for recommendations on insurers that have actually worked well for them in the past. Ads by Money. We might be compensated if you click this ad. Advertisement, Among the very best ways to pay less for car insurance coverage is by comparing vehicle insurance coverage quotes, Click below to start finding your lower rate today from Progressive - trucks.

Try to find bundling discounts You can save money by buying car insurance from a business with which you already have other kinds of insurance coverage, such as home insurance. You may likewise be able to bundle your vehicle insurance coverage with pet insurance coverage, if your business offers both (auto). (Bundling with life insurance coverage is more uncommon, even from companies that use it in addition to other insurance types.) The phrasing differs by insurance provider, but bundling discounts are often referred to as multi-policy, multi-product or multi-line discount rates.

Advertisement, If you currently have different insurance coverage providers for house and vehicle insurance coverage, you might be overpaying. You can save up to 25% when bundling both offers, which frees up your month-to-month spending plan.

Install anti-theft gadgets Depending on your insurance provider, installing a cars and truck alarm or a Lo, Jack could conserve you money depending upon your insurer. Some insurance providers provide to a 25% discount rate for having such anti-theft devices set up. Not all insurance companies are so generous, so be cautious of investing in such equipment just to get lower premiums.

Indicators on How To Save Money On Car Insurance: 7 Ways To Reduce ... You Need To Know

The use of your credit history as a consider figuring out premiums has actually been slammed by some consumer supporters, and is banned in California, Massachusetts and Hawaii (cheaper). In all other jurisdictions, however, how well you pay your expenses and other credit aspects are likely to impact your vehicle insurance expenses, even if you have an impressive driving record.

While improvements in your monetary record might not immediately affect your insurance rate, it's most likely that your premiums will ultimately reduce as your credit score boosts.

In other cases, taking some type of "chauffeurs ed" might even enable you to get some points removed your license. Ask your automobile insurance coverage company if they use any discount rates for finishing an accredited defensive driving course (trucks). Each state has various requirements for these, so contact your insurance provider to see which ones are authorized in your jurisdiction and to verify that investing in a course will equate into premium cost savings.

8. Change to a smaller automobile If you require a brand-new car, make the expense of cars and truck insurance coverage for your brand-new wheels among your purchasing requirements. Premium expenses will differ depending upon the automobile's size and cost, along with its incidence of claims and fix costs compared to other vehicles.

That stated, protection changes are typically made after major life modifications or when you change vehicles. Here are some good times to consider money-saving carry on your car insurance. When restoring your automobile insurance policy A good time to see if there's any way to decrease your auto insurance premiums is when you need to restore your policy.

When your life modifications Substantial turning points in your life like marrying or separated, or transferring to a brand-new city, can need revisiting your automobile insurance. And while you're making changes to your coverage, you can also check out ways to conserve (low-cost auto insurance). Another example is when you need to guarantee brand-new chauffeurs in your family.

These discounts may not be offered from all insurance coverage business or in all states. The Insurance Information Institute advises focusing on the last rate of your coverage, rather than on overall discounts.

How 6 Obscure Ways To Lower Your Car Insurance - Improv Traffic ... can Save You Time, Stress, and Money.

Progressive offers a few of the most versatile and thorough vehicle insurance coverage that can be customized to their needs. Click listed below for more information (prices). The bottom line on lowering your automobile insurance premium Here's a summary of the very best strategies to cut down on what you spend for your car insurance plan.

Insurance coverage providers vary in how they utilize rates algorithms, and in the customers they desire, so comparison shopping is among the very best methods to conserve. Most companies offer automobile insurance coverage discounts to those who buy several policies or kinds of coverage, so think about purchasing automobile insurance from the same carrier that sold you your house owners or occupants insurance coverage policy.

Vehicle insurance coverage can be a large monthly cost depending on various factors, some of which run out your control - trucks. Nevertheless, as with the majority of things involving your vehicle, there is a way to reduce this month-to-month or yearly cost. From great driver discount rates to advance payments, continue reading to find methods to reduce your automobile insurance costs.

There is a discount rate for you. Attempt these ways to minimize your automobile insurance costs if you think you're overpaying for protection.

https://www.youtube.com/embed/Y-iOvFg-rJI

You can likewise select a plan with a greater deductible to decrease your cars and truck insurance coverage premiums. Choosing a various strategy is a great way to minimize your costs, but keep in mind that minimizing your coverage or changing to a high-deductible strategy can also increase your danger. If you take this method, comprehend that you may have to pay more expense if you make a claim.

The smart Trick of Cancel A Policy With Us - American Family Insurance That Nobody is Talking About

To terminate your car insurance, you might need to mail, fax or email a fast letter to your insurance policy business stating that you intend to terminate as well as the reliable termination day - liability. If you don't cancel your plan on schedule and also stop working to make the settlement, it will obtain cancelled for non-payment eventually.

If you're getting protection in other places, see to it your brand-new plan remains in location and active before canceling your old policy. Otherwise, you may discover yourself out when driving without protection. Right here are a couple of means to cancel your policy: Calling your agent is normally the quickest and also most usual way to terminate your policy.

However, lots of insurer need an authorized cancellation notice. Ask your agent for details of the termination process as well as have them send out over any kind of cancellation papers that need to be authorized. If you do not wish to call, it's possible to mail or fax in your cancellation letter. Actually, numerous insurance provider will certainly need written alert.

You can send by mail the letter or, better yet, email it to your insurance company - business insurance. "Scan this letter or take a photo of it with your cell phone as well as email it to both your insurance policy as well as your agent," Johnson states. Keep in mind to adhere to up with the insurer in a couple of weeks as well as verify that any kind of staying unused premium has actually been returned to you.

A vital pointer: Always start the termination process after you have a brand-new plan in area. Permit a day or two overlap to make sure that your new policy is in location before terminating the old one. Make certain there is a paper or digital route of your termination. The last action in every one of this is to get a confirmation of termination from your insurer or agent.

How To Cancel A Car Insurance Policy And Get A Refund? Fundamentals Explained

Always review the great print when canceling insurance coverage The bulk of insurance coverage firms make terminating a plan a fairly uncomplicated process. "Depending on the insurance policy company, there might be various cancellation procedures.

As discussed previously, some insurance providers call for a termination letter while others might be pleased with a verbal cancellation over the phone. cars. Your plan ought to mean out what you need to do to effectively terminate your plan. Drawbacks to not terminating insurance properly Not terminating your plan as necessary brings about troubles.

This prolongs the policy for 20 days in the event you neglect to send out a repayment or if it gets lost in the mail. This elegance duration guarantees you're not driving without insurance policy since of an ignored payment. If you're switching over insurers though and have no intent of sending in a revival check, you could be responsible for the grace period premium.

Most of the times, it's possible to avoid spending for the moratorium however you will need to contact the insurance provider and also show evidence of your brand-new plan. vehicle insurance. While it will certainly depend upon the regards to your policy as well as state legislations, it's most likely that if you reveal evidence of another plan remaining in area, your insurance company will certainly just cancel your plan or non-renew you back to that end day of your policy, forgoing the moratorium costs.

It's always best to terminate your existing insurance coverage the proper way to prevent issues in the future (insured car). Canceling your insurance isn't constantly an excellent idea Dropping your automobile insurance policy can be a mistake. Right here are times you may wish to reconsider that choice: Currently, there are just two states that don't require motorists to bring cars and truck insurance coverage, Virginia and also New Hampshire.

The smart Trick of How Do I Cancel My Car Insurance? - Gio That Nobody is Talking About

Although insurance coverage isn't a need, you're still economically responsible for any crashes or damages brought on by your vehicle. In states that do not require insurance policy, you typically need to meet specific monetary limits that verify you can cover the costs of any at-fault mishaps. Unless you are fairly well-off, you should not be out on the road without coverage - insurance affordable.

Not just is it the law in practically every state, but insurance coverage can likewise be a financial lifesaver if you are in a crash. Auto crashes can lead to pricey clinical expenses, legal costs and the price to replace one more individual's cars and truck, making car insurance a need. Speak with your vehicle insurance agent to see if they can reduce your premium.

You still require insurance even if your automobile remains in a storage space device. In most states, if the cars and truck is registered as well as has a license plate, it requires to be guaranteed. On top of that, if the storage space system refute, is flooded or something in your system drops on it, you will certainly desire insurance coverage to cover the damage.

Getting a new automobile insurance policy Before you terminate your plan, you require to locate a new one. Purchasing your insurance policy protection on a normal basis is constantly a wonderful suggestion.

When searching for protection, obtain quotes from a minimum of five various insurance providers and contrast apples to apples when it pertains to insurance coverage levels and deductibles. Relevant Articles.

Cancellation Of Auto Insurance Policies for Dummies

Canceling your vehicle insurance and also reactivating it later on can be viewed as a gap in insurance coverage. When you relocate, it aids to contact your insurance policy carrier promptly to guarantee that your plan aligns with the auto insurance coverage legislations in your brand-new area or state. Just how to terminate your cars and truck insurance policy, Google "exactly how to terminate insurance plan" or "how do I cancel your auto insurance coverage," as well as you will obtain a range of outcomes.

Each supplier will likely have various requirements for terminating a plan. For instance, some service providers might require you to pay a cancelation cost or offer a 30-day notification in advance of your cancelation date. It might be beneficial to talk straight with an agent to be clear on what actions are needed.

The letter usually includes your plan number, name as well as day you want your policy canceled. automobile. If you paid for your plan upfront as well as have remaining months of insurance coverage, you might also choose to consist of a reimbursement ask for the extra part of your policy. Service providers will usually send a notice validating that your plan has officially been canceled.

When you relocate, If you transfer to another state where your current insurance policy firm does not use protection, you will require to obtain a plan from a car insurance provider that uses insurance coverage at your brand-new place. Arrange for the brand-new plan a few weeks beforehand to stay clear of a lapse in protection - vans.

You should start purchasing a new insurer a minimum of 6 to eight weeks before the end of the plan term, so you have sufficient time to protect new insurance coverage. When you intend to reduce insurance coverage, If you have an older vehicle you have outright, you could think about going down optional accident and also thorough insurance coverages - affordable auto insurance.

The Only Guide for How To Cancel Allstate Auto Insurance - Cover

It is essential to keep in mind that if you stop crash and also comprehensive, you will certainly have most likely to pay out of pocket if your auto is harmed or swiped so you need to be ready monetarily - insure. When you should not cancel your automobile insurance policy, While you can cancel your automobile plan at any kind of provided time, you may not always need to.

When you will certainly be driving, Terminating coverage on an automobile you still plan to drive might not be the very best idea, as it could place you at financial risk as well as potentially go against state legislations. Speak to a qualified insurance agent to read more about how driving your car without insurance can impact you.

Before relocating, contact your current auto insurance company to learn if you can move your coverage to the new state (vehicle insurance). Relocating can trigger your rate to alter since place is a consider determining costs. If your present insurer runs neighborhood firms, you might need to choose a new representative too.

You can add a brand-new partner to your present vehicle policy as well as in some cases even make a discount for getting married. You may also receive a multi-policy price cut if you and also your new spouse have insurance policy with the very same firm. If you get divorced, you can normally remove your ex's name from your current plan rather than terminating the policy altogether.

Make sure to check state demands. When your premium is high, A high costs does not necessarily imply you need to terminate your protection. trucks.

Cancel Your Policy - Tower Insurance Things To Know Before You Buy

A lot of auto insurance companies will certainly prorate your refund based on the Hop over to this website number of days your current plan was in impact. The insurance coverage industry is extremely regulated as well as each state has insurance statutes that regulate how companies must manage reimbursements.

In many states, like Texas, if you fund your premium through a costs money company, the insurer might return the extra premium to the finance firm, not you. Unless or else specified in a law, car insurance coverage business normally do not have the commitment to reimburse your money within an offered period.

Get in touch with your carrier prior to canceling to learn what the plan cancelation terms are. accident. Automobile insurance cancelation charges State laws can figure out if a fee is permitted, and, if so, it is up to the insurance provider to set that fee, which is frequently taken out of the prorated refund. If you ask your company concerning cancelation fees, knowing whether your state makes charges acceptable could help you prepare beforehand for any fees.

You will certainly be charged for the time your policy was energetic without settlement. Falling short to effectively alert your car insurance firm that you intend to cancel coverage may also influence your experience of finding vehicle coverage in the future. Even if you mean on discovering a new vehicle insurance provider, missing settlements entirely could result in inadequate settlement background and also make locating budget-friendly rates harder.

Do I require to terminate my plan if I move to an additional state? When you relocate, you will need to register your automobile in your brand-new state of house as well as acquire a policy that lines up with its automobile insurance policy laws.

How How To Cancel Geico Auto Insurance - Coverage.com can Save You Time, Stress, and Money.

Rather, you should call their client service at 1-800-776-4737 as well as demand to cancel your policy. Reasons For Canceling Your Plan, Most individuals terminate their plans when they've chosen to switch to an additional insurance policy supplier.

There are many factors to think about when the ideal policy for you. If you intend on still possessing an automobile, however you've terminated your insurance coverage, you require to get a new plan ASAP. Otherwise, you can be thought about lapsed, which can put you in jeopardy for fines from your state.

They are there to help! Purchase A New Plan Before Cancellation Of Your Existing Plan, Being without insurance for even a day can have expensive effects (cars). If you prepare to have a car after you cancel your plan, you will certainly require to have bought a brand-new policy prior to your cancellation date.

Letting your coverage gap can lead to obligation for damages triggered by an at-fault crash, along with high costs later on. low cost auto. A gap in protection on your document will certainly earn you a label of "risky driver."3 Indicate Take Into Consideration When Contrasting New Policies, If you have actually made the decision to leave your current policy, it is time to start purchasing a new policy.

https://www.youtube.com/embed/THM66awg850

Where to start?Get instantaneous quotes tailored to your requirements - fill in our brief type, today!.

The Only Guide for Lemonade: Insurance Built For The 21st Century

0-star customer rating and also just under 3,000 complaints filed in the last 3 years (affordable). This number of grievances may appear high, however it represents a small fraction of consumers when you take into account the fact that Geico is the second-largest automobile insurance policy service provider in the united state as well as Progressive is the third-largest, according to the National Organization of Insurance Policy Commissioners (NAIC).

Geico often tends to supply lower prices for many policyholders and has a little higher consumer fulfillment ratings, while Progressive has fantastic options for high-risk motorists and also even more commonly available usage-based insurance. Generally, here's just how we rate Geico vs (cheaper cars). Progressive: Other referrals for auto insurance coverage Geico as well as Progressive aren't your just excellent options for inexpensive automobile insurance.

cars business insurance cheapest car insurance cheaper

cars business insurance cheapest car insurance cheaper

We advise State Farm for student vehicle drivers based on its discount offerings. The Drive Safe & Save, TM and also Steer Clear programs both assist young chauffeurs conserve on insurance coverage costs (money). Of program, State Farm isn't just for young chauffeurs.

Power United State Car Insurance Policy Complete Satisfaction Study (auto insurance). It additionally has several of the most affordable prices on average. Nevertheless, protection is not readily available to every person. To be eligible for an automobile insurance coverage plan with USAA, you have to be a participant of the army or have a family members participant that is a USAA member.

Top Guidelines Of Determining Auto Insurance Rates - Geico

car affordable car insurance affordable car insurance liability

car affordable car insurance affordable car insurance liability

Our methodology Since consumers depend on us to give unbiased and also precise information, we created a comprehensive rating system to formulate our positions of the very best auto insurance policy companies. We gathered information on dozens of automobile insurance policy service providers to quality the business on a vast array of ranking aspects. Completion result was a general rating for each provider, with the insurance providers that scored the most factors topping the listing - prices.

car insured suvs trucks cheapest auto insurance

car insured suvs trucks cheapest auto insurance

insurance prices cars auto insurance

insurance prices cars auto insurance

Insurance coverage (20% of overall score): Companies that use a variety of selections for insurance protection are more probable to fulfill customer demands. Reputation (20% of overall rating): Our study team thought about market share, rankings from industry specialists and also years in business when offering this score (risks). Accessibility (20% of complete rating): Vehicle insurance provider with greater state schedule and few eligibility demands racked up highest in this classification.

There are thousands of Geico insurance coverage reviews uploaded online. Is Geico a reputable insurance firm?

Find out why in this short article, where we have a look at Geico vehicle insurance policy protection choices, prices, benefits, and assesses from policyholders. Geico Car Insurance Coverage Score: 4. 6 Stars We price Geico 4. 6 out of 5. 0 celebrities and also name it Click for more the Best Overall in 2022. The insurance provider's affordable rates and easy insurance claims process make it a clever choice for the majority of drivers.

Geico Car Buying Service - Questions

accident low cost prices accident

accident low cost prices accident

We also evaluated 1,000 vehicle insurance coverage consumers on a selection of subjects. In general, 36 percent of Geico consumers believe they experienced a price increase without an obvious cause. This is reduced than the average of 41 percent for all companies. Most states permit auto insurance provider to utilize credit history profiles in calculating rates. cheap auto insurance.

What you spend for car insurance coverage from Geico depends on your location. auto. Chauffeurs in some states might pay just $1,000 per year, while others might pay $2,000 or more for complete coverage insurance policy based upon area alone. Below's an overview of Geico's insurance policy costs by state, in addition to each state's ordinary according to our rate price quotes.

It consists of jump-starts, extra tire installation, lugging to a repair service shop, as well as lockout solutions as much as $100. Rental car repayment This protection pays for the costs of a rental auto while your car is being repaired after a covered insurance claim. Geico deals with Business Rent-A-Car, which indicates your insurance coverage will pay Enterprise directly (car insurance).

In the J.D - cheaper car. Power 2021 U.S. Auto Insurance Coverage Research Study, SM, Geico earned a complete satisfaction ranking over the regional standard in California and also the Central and also New England areas - automobile. There are lots of positive Geico insurance policy reviews on websites including Trustpilot as well as the BBB. On the BBB web site, Geico has an A+ ranking, showing that it quickly replies to customer grievances.

The 10-Second Trick For Insurance For Lyft Drivers

This put Geico in the top five companies by contentment level. In favorable Geico insurance coverage reviews, customers praise the simplicity of communication with the company's reps. "I have actually made use of Geico for the last [seven] years, as well as they have done a wonderful work for me. No concerns with insurance claims. No responsive rate hikes after insurance claims.

https://www.youtube.com/embed/JdYwDLvz6Fg

They help every time I call and also are constantly so friendly. I am proud to call them my insurance coverage company. You may save cash with Geico, however you waste a whole lot of time.

Great Low Auto Insurance Rates For California Uber Drivers! Things To Know Before You Buy

Edit your About page from the Pages tab by clicking the edit button.

The smart Trick of Commercial Auto Insurance Cost - Insureon That Nobody is Talking About

Edit your About page from the Pages tab by clicking the edit button.

How Car-insurance-uber-doordash-lyft - Money can Save You Time, Stress, and Money.

Edit your About page from the Pages tab by clicking the edit button.

The smart Trick of Rideshare Insurance - Progressive Commercial That Nobody is Talking About

Edit your About page from the Pages tab by clicking the edit button.

How How Can Uber Drivers Get Commercial Insurance? - Youtube can Save You Time, Stress, and Money.

Edit your About page from the Pages tab by clicking the edit button.

Everything about How To Pick The Best Commercial Auto Insurance - Agency ...

Edit your About page from the Pages tab by clicking the edit button.

Rideshare Insurance Can Be Fun For Everyone

Edit your About page from the Pages tab by clicking the edit button.

The Best Guide To Rideshare Insurance - Best Companies To Buy Coverage(2022)

Edit your About page from the Pages tab by clicking the edit button.

Rideshare Insurance for Dummies

Edit your About page from the Pages tab by clicking the edit button.

7 Simple Techniques For Rideshare Insurance

Edit your About page from the Pages tab by clicking the edit button.

Top 25 What Is Rideshare Insurance Resources Can Be Fun For Everyone

Edit your About page from the Pages tab by clicking the edit button.

Facts About What Is Rideshare Insurance? - Progressive Revealed

Edit your About page from the Pages tab by clicking the edit button.

Rumored Buzz on Car Insurance For Seniors - Bankrate

Edit your About page from the Pages tab by clicking the edit button.

Not known Facts About The Best Cheap Car Insurance Companies Of 2022 - Business ...

Edit your About page from the Pages tab by clicking the edit button.

The Ultimate Guide To Cheap Car Insurance - Progressive

Edit your About page from the Pages tab by clicking the edit button.

9 Easy Facts About Compare Older Drivers Car Insurance Quotes At Gocompare Described

Edit your About page from the Pages tab by clicking the edit button.

The Cheapest Car Insurance Companies (April 2022) Can Be Fun For Anyone

Edit your About page from the Pages tab by clicking the edit button.

Not known Details About Motor Age - Volume 32 - Page 19 - Google Books Result

Edit your About page from the Pages tab by clicking the edit button.

Getting The How Might I Reduce My Premium If I Want To Stay With My ... To Work

Edit your About page from the Pages tab by clicking the edit button.

What Does How To Lower Car Insurance For A Teenager - Shopping Guides Mean?

Edit your About page from the Pages tab by clicking the edit button.

Can You Negotiate Car Insurance To Get A Better Rate? - The ... - An Overview

Edit your About page from the Pages tab by clicking the edit button.

The Basic Principles Of 5 Ways To Lower Your Car Insurance Now. - Carinsurance.com

Edit your About page from the Pages tab by clicking the edit button.

Get This Report about 11 Simple Ways To Lower Car Insurance Premiums

Edit your About page from the Pages tab by clicking the edit button.

Things about Decrease Your Car Insurance Premium With One Simple Call

Edit your About page from the Pages tab by clicking the edit button.

Excitement About How Can I Use A Calculator To Find Out How Much Home ... - Jerry

Every one of this assists insurance providers determine the risk linked with guaranteeing your vehicle in that ZIP code, whether you ever before have made a claim or otherwise. All various other elements equal, your postal code can alter your rate by hundreds of dollars. Just how does my marital standing impact my vehicle insurance price? Car insurer say that wedded couples have actually been discovered to have fewer crashes as well as cases than single chauffeurs do, which is why married motorists pay less than solitary chauffeurs.

There are also various other vehicle insurance coverage price cuts couples can eagerly anticipate when they combine their plans, such as a multi-car price cut, or a multi-policy discount rate if they have a tenants or property owners policy with the same insurer. An insurer considers you single if you have actually never ever been married, or are widowed or separated.

Some insurance companies turn down anyone with four or more chargeable mishaps in three years, or even more than three Drunk drivings in 7 years, or more than 15 factors on the chauffeur's motor car record. Generally, a small infraction such as a speeding ticket can increase your rates, usually, by 25% to 43% - auto.

5% much less, on average, contrasted to drivers with longer commutes, an Auto, Insurance coverage. Just how does gas mileage affect cars and truck insurance coverage prices? If you drive 12,000 miles a year, or much less, your insurance policy business will commonly think about that to be reduced than average, and also you'll likely pay a lower rate than those that drive more than that.

To obtain the ideal low-mileage discounts, which are concerning 7% usually, you usually need to drive under 7,000 or 5,000 miles annually. Based upon a Los Angeles motorist with a full coverage plan, the cost of a plan when the motorist logged 20,000 or even more miles was 12% extra pricey than if just 5,000 miles were driven a year. car.

We asked Charles, the adhering to inquiries regarding credit rating history and also insurance policy prices: What are the benefits and drawbacks of utilizing a motorist's credit rating when setting vehicle insurance rates? Determining and also awarding vehicle drivers with excellent credit score habits can yield consistent revenue and company stability for insurance companies (cheap insurance). A consumer's credit report history claims a great deal concerning them.

Some Ideas on Calculate Car Insurance Premium Online - Turtlemint You Need To Know

In the long-term, insurance business's growth could be limited if some customers are evaluated of the marketplace, this can have a plunging impact where reduced sales cause decrease revenues as well as reduced ROI - perks. It may be best to take computed dangers as well as make policies offered at affordable rates to those with lower credit history.

Let's select a company maybe. Standard customers, with excellent credit rating ratings, are a necessary base for a strong insurance policy business. These customers are consistent concerning paying their bills as well as insurance providers should award them with the most effective prices. On the other hand, those with reduced or weak credit report may have fallen under a poor spot and had trouble paying costs for a duration, however that doesn't automatically imply that they're mosting likely to be negligent when traveling.

But insurance companies are all concerning threat and also numbers, and also if their research says that people with inadequate credit rating are often poor chauffeurs, one might make the disagreement that charging greater dangers is reasonable. Even if it kind of seems like the insurer is kicking the individual with negative credit history while they're down.

Consumers with reduced debt ratings sometimes will not receive month-to-month billing, or they might need to pay a large portion of the plan in advance and also the rest monthly. Regardless, fair or not, credit history scores typically do have an effect on one's insurance costs. If you desire them to go down, it makes feeling to try to make your credit history rating go up.

The even more protection you obtain, the much more you will pay. If you get a simplistic responsibility plan that covers just what the state calls for, your vehicle insurance prices are going to be much less than if you bought protection that would certainly fix your very own auto, as well. Responsibility insurance coverage often tends to cost even more because the quantity the insurance provider risks is higher. affordable auto insurance.

cheapest auto insurance cheapest car liability low cost

cheapest auto insurance cheapest car liability low cost

If you don't have adequate responsibility insurance coverage, you can be filed a claim against for the distinction by any individual you harm. The higher the deductible, the much less the insurance policy company will certainly have to pay-- and the lower your rates.

10 Easy Facts About Car Costs Calculator - Moneyhelper Described

Without some sort of medical protection, if you do not have medical insurance elsewhere, you may not have the ability to pay for therapy if you are wounded in an accident you triggered (insurance affordable). One method some motorists can restrict their insurance policy prices is with pay-as-you-drive insurance. This type of insurance bases the price of your premium on just how much you drive, and also might take into consideration other driving habits as well.

Otherwise, these drivers "pay roughly the same yearly repaired expenses for insurance as another vehicle driver with high yearly mileage. Reduced mileage motorists would certainly have the best motivations to switch over to pay-as-you-drive."Besides potentially conserving cash for reduced gas mileage drivers, pay-as-you-drive insurance policy can give a reward to drive much less. Explains Parry: "By elevating the minimal cost of driving it would affect people to drive a bit less - specifically for those with high risk variables as reflected in high score aspects (as they have greater insurance coverage prices per mile)."Parry includes that the benefit of this motivation to drive less may expand beyond the money conserved by consumers with pay-as-you-drive insurance."There would be some modest advantages from minimizing opposite impacts from vehicle usage - some moderate reduction in carbon and also neighborhood air discharges as well as website traffic congestion as accumulated lorry miles driven is reasonably reduced."Just how much is automobile insurance policy each year? Below's just how much the ordinary chauffeur, with excellent credit and also a tidy driving record, would certainly pay for the adhering to insurance coverage amounts, based upon Automobile, Insurance coverage.

The average price for 50/100/50 is (business insurance). The typical price for 100/300/100, with extensive as well as collision and also a $500 deductible is. Bumping state minimum as much as 50/100/50 costs simply $129, so it's just around $11 a month-- Mosting likely to 100/300/100 from 50/100/50 costs, to increase your responsibility defense.

Hypothetical drivers with clean records as well as excellent debt. Ordinary prices are for comparative purposes - vans. Your very own price will depend on your driving profile.-- Michelle Megna added to this write-up.

cars insured car cheap insurance cheaper car

cars insured car cheap insurance cheaper car

Trying to find an Automobile Insurance Cost Calculator? When it pertains to vehicle insurance, your policy is special to you. An auto insurance policy calculator assists determine what your cost will certainly be by considering your coverage requires, place and also other personalized details, all while assisting recognize the most effective protection for you.

Exactly How to Compute Car Insurance policy Every vehicle insurance provider has its very own method to calculate rates for your Learn more here car insurance policy quote. car insured. There are some vital elements that all insurance firms will certainly evaluate, like: If you do not have any kind of violations or crashes on your document, it shows you're a secure vehicle driver, which can lead to a reduced auto insurance coverage expense.

Getting The Car Costs Calculator - Moneyhelper To Work

accident accident cheaper car insurance liability

accident accident cheaper car insurance liability

Your auto insurance policy might set you back more than those that live in country locations. perks. Automobiles go with collision safety examinations to determine the danger of major injuries in a crash. If the automobile you drive is newer and also has a high safety and security examination score, you might have a lower vehicle insurance policy price.

If you're retired as well as don't drive much, your rate may be less than a person that commutes 50 miles a day for job. prices. One of the most significant aspects affecting the price of your insurance costs is just how much coverage you need. If your state requires you to lug greater responsibility restrictions, or you're insuring numerous automobiles, your cars and truck insurance coverage price might be higher.

Not all automobile insurance coverage business are the very same. Each one utilizes its own formula to determine auto insurance coverage prices (low-cost auto insurance).

The cheapest vehicle insurance plan might not offer you the protection that you as well as your loved ones require on the road. Make sure you contrast auto insurance coverage estimates meticulously to guarantee you obtain the full insurance coverage you need (car insurance). A calculator tool can be a practical place to start if you do not know what insurance coverages you require, however automobile insurance policy calculators will not assist identify just how much you need for automobile insurance.

Miss the Car Insurance Coverage Calculator and also Obtain a Quote There isn't a one-size-fits-all vehicle insurance coverage plan. It's also real that not all insurance companies' auto insurance coverage calculators are the exact same and many insurance providers determine prices in a different way.

Obtaining quotes before you acquire car insurance coverage is a very easy means to see to it you do not pay even more than you need to for coverage. Great deals of elements influence what you pay for vehicle insurance coverage, including your place, age, driving history, and also much more. That's why the most effective method to estimate your rates is to use an auto insurance policy calculator that considers some of that information.

The Buzz on Car Insurance Calculator - The Hartford

vehicle insure car insurance affordable

vehicle insure car insurance affordable

We don't sell your information to 3rd parties. Just how to get insurance coverage quotes, As long as you have actually got some standard information at the all set, it's very easy to obtain quotes for car insurance coverage. Before you purchase a vehicle insurance plan, ensure you take these steps to obtain one of the most accurate price quotes: Comprehend your coverage choices, Choose just how much you intend to pay, Obtain estimates from several firms, Comprehend your coverage alternatives, A car insurance coverage plan is comprised of various sorts of coverage that provide different kinds of protection (cheapest car insurance).

Comprehensive insurance coverage: Covers the price of damage not triggered by an automobile crash, like damage from severe weather, falling items, burglary, vandalism, or pets - vehicle. Collision coverage: Covers damages to your own vehicle after an at-fault mishap. Accident protection (PIP): Pays for your own clinical expenses after an accident, despite that was at-fault (PIP is required in no-fault states). These sorts of cars and truck insurance coverage typically comprise what's called a full-coverage policy, but there are other coverage add-ons you may desire to take into consideration, including roadside help, brand-new car replacement, and rental car compensation coverage.

The more protection you acquire, the a lot more costly your car insurance coverage estimates will be. credit score. For instance, if you only purchase adequate insurance policy to meet your state's minimum requirements, your estimated insurance coverage price may be an average of 66% (or $1,184 each year) less costly than a full-coverage policy that includes higher limits of liability protection as well as thorough and crash protection.

While obtaining totally covered ways your insurance price quotes will be greater, it's the very best means to stay clear of spending for pricey clinical bills as well as home damage expense after a major vehicle mishap. Establish a quantity you're comfy paying per month or each year so you can look around for the company that offers you one of the most coverage at the most affordable prices.

https://www.youtube.com/embed/0MumTy8JWwA

We don't sell your details to third celebrations. insurance. What affects your car insurance policy expense quotes, While the average vehicle driver pays $1,652 annually for car insurance policy, every chauffeur will certainly see various price quotes for vehicle insurance depending upon a series of aspects. A few of the details that can assist you estimate just how much your cars and truck insurance will be are: Where you live: Motorists in one state may pay numerous bucks extra for automobile insurance protection than vehicle drivers in an additional.

Best Ways To Make Your Car Insurance Payment - The Balance for Beginners

A lot of vehicle insurance coverage limit an insurance company's responsibility to the auto's ACV or the expense to repair or replace it. So, if you're in a state without a statute, you may not obtain assist with sales tax obligation. Talk with the insurance policy adjuster about your state's circumstance if your insurance provider totals your automobile.

To have money from your insurance case to place down on a substitute cars and truck, you would require to owe less than your funding quantity. In that situation, you would certainly obtain the cash staying after the lending institution was paid off. Or if you possessed the car outright, every one of the cash would come to you to place towards a new auto. affordable auto insurance.

If you owe a lot more on the financing than the real cash money value of the auto, you will still owe the remaining balance to your lending institution. What are the reasons space insurance policy will not pay the equilibrium owed on my completed automobile?

Furthermore, if there are other points consisted of in your funding like an extended service warranty, void insurance will certainly not cover that benefit. Can a completed vehicle affect my credit rating rating?. There could be some indirect results either positive or adverse, of paying off your vehicle. For instance, if your vehicle finance is your oldest credit scores account and you pay it off, you will certainly occasionally see a reduction in your credit rating.

Is fixing a completed auto worth the effort? The solution to this depends on several factors, including your personal demands. Do your research as well as carefully take into consideration any kind of financial investment that will drop as well as see little to no return. Ensure you recognize specifically what will certainly need to be done to the vehicle to fix it, just how much that will certainly cost as well as how long the automobile should reasonably last after fixing.

We recommend doing some study to figure out the most safe automobiles and also least expensive lorries to insure, then compare those with your automobile demands and purchase expenses prior to making your choice. It is also essential to consider what you need to pay on a down settlement if you will be funding a lorry.

Some Ideas on Does Paying Car Insurance Build Your Credit History? - Chase You Need To Know

Most insurer utilize a 3rd party to review your automobile's money value. What happens if the complete loss had not been my fault? If your vehicle is completed and it had not been your mistake, after that an additional chauffeur's liability insurance coverage will pay for the damages to your automobile. You will just get the cash for the value of your cars and truck, not the total replacement expense.

prices vehicle insurance credit cheapest auto insurance

prices vehicle insurance credit cheapest auto insurance

business insurance affordable low cost auto vans

business insurance affordable low cost auto vans

Automobile insurance lapses after the elegance period for the plan finishes without any payment being made. The majority of insurer have a moratorium for late payments, typically around 10 days, however not all insurance companies or state legislations allow them. New York, as an example, does not allow moratorium on any kind of sort of insurance policy. insurance company.

Any type of and all expenditures would certainly be coming out of your pocket. Plus, like your home or auto, gaps in protection could increase your insurance for these playthings in the future. So as opposed to default on a repayment, take into consideration functioning with your insurer to lower protection for playthings in the off-season. cheap car.

How to conserve on your insurance Rather than not paying your premium entirely, it's worth checking into methods to reduce your prices for the time being. cheaper auto insurance. You could think about reducing your insurance coverage briefly, as well as you can re-add protection to your policy later when you remain in a various monetary scenario. What can you do to reduce the price of your insurance coverage premium? Missing an insurance policy premium repayment can have severe long-term influences.

Force-placed insurance policy often tends to be drastically extra pricey with reduced insurance coverages as well as if you stop working to pay for the plan, your automobile will certainly more than likely be repossessed - cars. You can change the force-placed insurance plan with one more insurance coverage policy you discover however you will need to pay for the amount of time you had the force-placed policy.

If you basic forgot to pay your costs as well as it's just been a couple of days, call your insurer as well as ask if they will certainly reinstate your policy as they might want to assist. Expect your premium to be higher if the Helpful resources gap goes past a week. If you have not had insurance coverage for months, understand that insurance firms are much more likely to bill a greater rate as well as some might not want to guarantee you at all.

The Facts About Do You Really Need Gap Insurance? - Investopedia Uncovered

A Brightway representative will be able to go shopping the marketplace as well as give you options from various insurance brand names. Request any and also all price cuts that you get Once you've gone 6 to year without incident, ask your insurer to recalculate your rates If you ever discover yourself in a position where you are worried about paying your Auto insurance coverage bills on schedule, take into consideration the complying with details in order to stay clear of coverage lapses: Consider the choice of suspending your policy if you know you will be gone with a particular amount of time (prices).

Make certain to make any type of payments before the expiration day - affordable car insurance. * Information courtesy of Trusted Choice.

Any and also all expenditures would certainly be coming out of your pocket. Plus, like your house or vehicle, lapses in protection could raise your insurance coverage for these toys in the future. Instead than default on a settlement, think about functioning with your insurance provider to reduced protection for playthings in the off-season. suvs.

cheaper cars cheaper cars vehicle insurance money

cheaper cars cheaper cars vehicle insurance money

Exactly how to reduce your insurance policy Instead of not paying your costs completely, it deserves exploring ways to lower your prices for the time being (credit). You might take into consideration minimizing your protection briefly, and also you can re-add protection to your policy later on when you remain in a different economic circumstance. What can you do to reduce the price of your insurance policy premium? Missing out on an insurance policy premium payment can have significant lasting effects.

Force-placed insurance coverage often tends to be significantly a lot more expensive with decreased insurance coverages and if you fail to spend for the policy, your automobile will certainly greater than likely be repossessed. You can change the force-placed insurance policy with one more insurance plan you find yet you will certainly have to pay for the quantity of time you had the force-placed policy - car.

If you simple forgot to pay your expense and it's just been a few days, call your insurance firm and ask if they will certainly restore your policy as they might agree to assist. Nonetheless, anticipate your premium to be greater if the gap transcends a week. If you have not had insurance policy for months, understand that insurance firms are a lot more likely to charge a higher price and also some may not want to insure you in any way (dui).

What If You Can't Pay Your Deductible? - Carinsurance.org - An Overview

A Brightway representative will certainly be able to go shopping the marketplace as well as provide you options from numerous insurance coverage brand names. Request for any and also all price cuts that you qualify for When you have actually gone 6 to twelve month without incident, ask your insurance firm to recalculate your rates If you ever locate yourself in a position where you are concerned regarding paying your Vehicle insurance costs on schedule, consider the adhering to details in order to prevent coverage lapses: Check into the option of suspending your policy if you know you will be gone with a certain quantity of time.

Ensure to make any payments prior to the expiration day. * Info thanks to Trusted Choice - cheapest car insurance.

Any kind of as well as all costs would certainly be coming out of your pocket. And also, like your home or vehicle, lapses in protection can raise your insurance policy for these toys in the future. Instead than default on a payment, consider working with your insurance provider to reduced insurance coverage for toys in the off-season.

Exactly how to conserve on your insurance Rather than not paying your costs altogether, it's worth looking into means to lower your expenses for the time being. Missing out on an insurance costs repayment can have major long-term impacts.

Force-placed insurance tends to be dramatically more costly with decreased insurance coverages as well as if you fail to spend for the plan, your car will extra than most likely be repossessed. You can change the force-placed insurance plan with an additional insurance plan you locate yet you will certainly need to pay for the quantity of time you had the force-placed policy.

If you simple neglected to pay your expense and it's just been a few days, call your insurance provider and ask if they will certainly renew your policy as they might agree to help out. Expect your costs to be higher if the lapse goes past a week. If you have not had insurance coverage for months, understand that insurers are most likely to bill a higher rate and also some might not be ready to guarantee you at all (insurance).

The 9-Minute Rule for Should You Pay Off Your Car Loan Early? - Bankrate

A Brightway representative will certainly have the ability to go shopping the market and also provide you options from different insurance coverage brand names. Request any type of and also all discounts that you get When you have actually gone 6 to one year without event, ask your insurance provider to recalculate your rates If you ever find yourself in a placement where you are concerned concerning paying your Auto insurance coverage costs promptly, take into consideration the complying with info in order to avoid insurance coverage lapses: Look right into the alternative of suspending your policy if you know you will be gone for a particular quantity of time.

Ensure to make any kind of payments before the expiry date. cheap car. * Details thanks to Trusted Choice.

Any type of as well as all costs would certainly be coming out of your pocket. And also, like your house or car, gaps in protection might increase your insurance for these playthings in the future. So instead of default on a payment, consider dealing with your insurer to lower insurance coverage for playthings in the off-season (automobile).

How to save money on your insurance coverage Instead of not paying your costs altogether, it deserves looking right into methods to decrease your costs for the time being. You may consider reducing your protection momentarily, and you can re-add coverage to your plan later on when you remain in a different financial scenario. What can you do to minimize the expense of your insurance coverage premium? Missing out on an insurance premium repayment can have severe lasting effects.

Force-placed insurance coverage has a tendency to be considerably extra pricey with minimized insurance coverages as well as if you stop working to pay for the policy, your auto will certainly extra than most likely be repossessed - low cost. You can replace the force-placed insurance coverage policy with an additional insurance coverage you discover however you will have to pay for the quantity of time you had the force-placed policy.

If you straightforward forgot to pay your bill as well as it's only been a few days, call your insurance company and ask if they will certainly reinstate your plan as they may agree to assist. Nonetheless, anticipate your premium to be greater if the lapse transcends a week. If you have not had insurance for months, understand that insurers are more likely to bill a greater price as well as some may not want to guarantee you whatsoever. cheaper.

A Biased View of Behind On Car Payments Because Of The Coronavirus?

A Brightway agent will certainly have the ability to shop the market as well as provide you options from different insurance coverage brands. Request for any kind of and also all price cuts that you get approved for Once you have actually gone 6 to year without case, ask your insurance firm to recalculate your prices If you ever before discover yourself in a placement where you are concerned regarding paying your Car insurance policy costs on time, consider the adhering to information in order to prevent insurance coverage gaps: Explore the alternative of suspending your plan if you understand you will be gone for a particular quantity of time.

https://www.youtube.com/embed/BsxDjx686lQ

Ensure to make any type of settlements prior to the expiry day. laws. * Details thanks to Trusted Option.

A Biased View of 10 Ways To Cut Down Your Car Insurance Costs In Connecticut

If you do this, place your financial savings right into your emergency fund and know that you are taking on included threat. cheaper. Update Your Driving Patterns If you drive less than 8,000 miles a year, you might certify for a low mileage price cut. Many business provide a low mileage discount and the variety of miles will vary, yet it's typically in the 7000-8000 region (accident).

Some states mandate the discount rate. In New york city, as part of the Factor & Insurance Coverage Reduction Program, you will certainly obtain a 10% reduction of the base price of your automobile insurance coverage premiums each year for 3 years). Examine with your insurance company before you enroll in a class due to the fact that they cost money and time, so you do not wish to be squandering it on a course that will not conserve you cash.

insurance companies cheap insurance car insurance low cost auto

insurance companies cheap insurance car insurance low cost auto

Auto insurance policy does drop at 25. The average price of car insurance coverage for a 25-year-old is $3,207 for a yearly plan. By contrast, motorists pay an average of $7,179 at 18 and $4,453 at 21 which shows that car insurance policy does decrease as you age. Nonetheless, this turning point isn't as enchanting as you could assume.

Read on to discover more information concerning when automobile insurance coverage does go down. When does cars and truck insurance get less expensive for young vehicle drivers?

What age does cars and truck insurance policy drop for male vs women motorists? Your cars and truck insurance policy does decrease after you turn 25, yet not as long as it does on various other birthdays - insurance company. Nevertheless, unless you live in a state where insurers can't factor gender right into insurance policy rates, one considerable adjustment happen at age 25: the distinction between what male and women drivers pay for cars and truck insurance - affordable auto insurance.

Does car insurance from major nationwide insurance firms drop at 25? We evaluated quotes from 4 of the biggest automobile insurance policy business Geico, State Ranch, USAA as well as Progressive as well as discovered that while automobile insurance coverage does decrease at 25 with each of them, the amount it decreases by differs substantially (cheap car).

Rumored Buzz on Nine Ways To Lower Your Auto Insurance Premium

Unless you reside in one of the few states that have made it unlawful, a lower credit history might raise your automobile insurance policy premiums - insurance companies. If you relocate to an area with higher rates of theft and criminal damage, after that insurance providers will charge you greater costs to account for the increased risk of damage or burglary.

cheapest auto insurance car insurance trucks cheap car

cheapest auto insurance car insurance trucks cheap car

Every insurer determines rates in different ways, and also some insurer will emphasize different aspects extra heavily than others. money. We recommend reassessing your insurance company each year to obtain the ideal rate. Exactly how to obtain more affordable automobile insurance coverage as a 25-year-old driver If you're a young driver in your 20s, you've likely questioned exactly how to lower your auto insurance policy expenses. credit.

Techniques for just how to make Additional resources your cars and truck insurance coverage go down By the time you hit age 25, you have actually likely passed the point where you can remain on your parents' insurance coverage - cheapest. (If you have not, nevertheless, you ought to absolutely do so, considering that this is just one of the ideal methods for young motorists to reduce their premiums.) The good news is, there are various other ways for 25-year-olds to get their insurance rates to decrease.

As your cars and truck's value decreases gradually, nonetheless, take into consideration minimizing or removing collision and comprehensive protection. If your car is just worth a couple of thousand bucks, it doesn't make good sense to shell out for high premiums to cover an asset of limited value - automobile. If you're married as well as each of you drives different vehicles, you might have the ability to reduce your vehicle insurance coverage settlement by, as insurance firms think about wedded pairs much more solvent and risk-averse - insure.

risks insurance cheap auto insurance insurance

risks insurance cheap auto insurance insurance

Discounts for 25-year-old motorists As you look around for the best price, make certain you're additionally asking insurer concerning all appropriate discount rates. affordable. Twenty-five-year-old motorists could not be able to benefit from student-away-from-home or good-student policies, but there are a lot of other ways these young drivers can save money on vehicle insurance: You may not have the ability to get a good-student discount any longer, but your university might have partnered with an insurer to safeguard discounts for graduates. laws.

car insure dui auto insurance

car insure dui auto insurance

low cost insurance companies cheapest car insurance affordable auto insurance

low cost insurance companies cheapest car insurance affordable auto insurance

By taking a, you'll not only discover how to drive even more securely, yet you can lower your auto insurance policy premium anywhere from 5% to 20%. Be recommended, nevertheless, that some states as well as some insurers only expand this discount rate to senior citizens or drivers under 25. Get in touch with your insurer to see if you qualify before you authorize up for a course.

Examine This Report about How Much Does Car Insurance Cost, And How Can I Lower ...

https://www.youtube.com/embed/GAdCxuhINLcDoes your vehicle have particular security attributes, such as anti-lock brakes or daytime running lights? Ask about these discount rates when you call insurance policy business for a quote (insurance company).

The Basic Principles Of Why Do Insurance Companies Total Cars?

cheapest affordable auto insurance insurance insurers

cheapest affordable auto insurance insurance insurers

Your Choices After Your Automobile Is Completed A complete loss insurance coverage claim is usually extra difficult than obtaining an auto fixed. Five Actions to Take Right After Your Car Is Totaled Many complete loss mishaps are quite severe.

cheapest insurance company car cheapest auto insurance

cheapest insurance company car cheapest auto insurance

As soon as the shock of the mishap has actually passed, you ought to: Overall loss cases can take a lengthy time to procedure, so contact your insurance provider as well as the insurance provider of any various other individual or entity involved in the mishap asap. cheaper car insurance. For instance, if one more driver hit you, call your insurance company and also that driver's insurance firm to report the crash.

The store will offer your insurer a quote for repairs as well as the insurance adjuster will certainly decide whether to complete the car. You'll require to offer the insurance policy firm with your auto's title. If you do not have it, you can ask for a duplicate from the Division of Motor Cars in your state.

Believe carefully concerning whether it makes financial feeling to keep an amounted to vehicle. You'll need to have it repaired, checked, as well as reinsured to get the auto back when driving. Some people choose to contribute their totaled cars to philanthropic companies for a tax obligation reduction. You can ask your preferred charity if they deal with a car contribution solution or auction house.

Faqs Regarding Repairs To Your Vehicle - Ct.gov for Dummies

What If I Want to Total the Car but the Insurer Doesn't? You can ask the insurance provider to complete your vehicle, yet insurance providers eventually choose whether to amount to a car based on the cars and truck's market value and the degree of the damage. car. Do You Pay a Deductible When Your Car Is Completed? You might need to pay your insurance deductible for a completed vehicle.

Typically, an insurance deductible is a collection dollar quantity. For instance, if the ACV of your amounted to automobile is $5,000 and you have a $1,000 insurance deductible, your insurance company will pay out $4,000 ($5,000 - $1,000 deductible) - automobile. You may not have to pay the insurance deductible if you aren't at mistake for the mishap that completed your automobile.

If you go to all legitimately in charge of an auto accident (negligent), your responsibility insurance coverage compensates various other people for their injuries and damage to their property. (Concerning a lots no-fault automobile insurance policy states have a various system, however obligation insurance policy normally covers home damages also in those states.) If your automobile was completed in an accident that had not been completely your fault, you can submit a third-party insurance claim under responsibility insurance coverage with the various other motorist's or cars and truck proprietor's insurer - insurers.

Comprehensive Coverage Comprehensive insurance coverage covers damages that isn't brought on by a crash with one more auto. If your cars and truck is amounted to by a fire, a fallen tree, or severe climate, your extensive insurance insurance coverage will likely begin. Comprehensive coverage also could cover damages caused by hitting a pet while driving depending on your policy.

Some Known Details About How To Make Insurance Total Your Car – Insurance Adjuster ...

If you have a crash with an underinsured or without insurance driver, you could be able to get settlement for your amounted to vehicle from your without insurance vehicle driver insurance coverage (UIM), if you have it. cheaper car. All-time Low Line on Who Pays The lower line is that the other chauffeur's or cars and truck owner's insurance company will spend for your totaled auto if the other motorist was at fault for the mishap (irresponsible).

If the at-fault motorist is underinsured or uninsured, you'll have to count on your accident or UIM coverage. If you caused the accident, your obligation protection will pay other individuals for their injuries and also damages to their property, yet you'll have to rely upon your collision coverage to pay for your amounted to automobile.

Discover much more about what occurs when you remain in a car accident and also without insurance. Just How Much Will Insurance Pay for My Amounted To Car? Each sort of insurance coverageliability, accident, thorough, UIMhas its own policy limitations (business insurance). The policy limitation is the complete quantity the insurer will spend for a solitary crash or claim.

Your car's AVC is $25,000, but the at-fault motorist has only $10,000 of property obligation protection. That vehicle driver's insurance company will pay just $10,000 toward your complete loss negotiation. The only way for you to obtain the staying $15,000 of your cars and truck's ACV would certainly be from your very own crash insurance coverage or underinsured driver protection - low cost auto.

The 5-Minute Rule for Accident - Louisiana Department Of Insurance

Who Gets the Negotiation Inspect? If you own the cars and truck, the insurance provider will pay you straight. If your car is financed, the insurance business will pay your loan provider. If the negotiation amount is more than what you owe your loan provider, you'll obtain the rest. If the settlement quantity is much less than what you owe, you'll be liable for paying the rest of your loan.

Timeline for a Failure Negotiation The quantity of time it requires to settle a failure automobile mishap situation differs from a couple of weeks to several months. The timing depends upon how swiftly you file your claim, exactly how very easy it is to find out that was at mistake for the crash, state laws, and whether attorneys are associated with the arrangements.

What If I Still Owe Cash on a Total Loss Vehicle? If the insurance company states that your auto is a complete loss, it will only pay you the reasonable market worth of your automobile at the time of your mishap, no issue exactly how much cash you owe on your automobile funding.

The actual money value of your cars and truck is just $12,000. The insurer is just going to pay you $12,000, leaving you with an equilibrium of $2,500 to pay on your finance for a car you can no much longer drive.

Is A Flooded Car Considered A Total Loss By Insurance ... Can Be Fun For Everyone

credit score credit vans low cost

credit score credit vans low cost

When you're funding a vehicle, you don't own it, the financial institution does. As you pay off your automobile financing, you will commonly owe even more than your cars and truck is presently worth as a result of vehicle loan rate of interest prices and also devaluation. Void insurance covers the difference ("gap") in between what you still owe on your financed cars and truck and the cars and truck's ACV. cars.

When you've identified your loan benefit amount as well as the amount the insurance provider intends to spend for the loss, you can compute just how much money you will need to take down on your following automobile. If you are stuck owing money for a completed auto, your loan provider may be able to settle what you owe right into a new automobile funding.

If you have inquiries about your rights and alternatives, talk to a vehicle accident legal representative. An attorney can address your concerns, discuss with insurance providers, and also represent you in court if essential. It deserves the expenditure of employing a legal representative when you don't really feel the insurance provider is supplying a reasonable settlement for your amounted to cars and truck (low cost).

You can also get in touch with an attorney directly from this page totally free.

Some Ideas on Should You Buy Back Your Totaled Car? - Autotrader You Need To Know

cars affordable auto insurance liability insurers

cars affordable auto insurance liability insurers

What Is a 'Amounted to' Cars and truck? Depending on your state and also whether you or another chauffeur were at mistake in the mishap, the damages to your cars and truck may be covered either by your insurance policy or the other driver's. insurance.

The adjuster's job is to determine how much their company needs to pay out on the claim. The insurance business may call your car an overall loss if the cost of repairing it exceeds 80% of its value.

Crash insurance coverage is for damages to your automobile created by a crash with another lorry, while detailed coverage is for damage created by something else, such as a fire or dropped tree.

Alternative 1: Allow the Insurance Coverage Firm Pay You The easiest way to deal with a completed auto after a mishap might be to just allow the insurance provider pay you (insure). Depending on the insurance coverage regulations in your state, this may involve: Replacing your amounted to car with an equivalent one Supplying you a money repayment that's equivalent to your amounted to automobile's real cash money worth Keep in mind that if you believe the insurer's offer is also reduced, you can challenge it.

The Single Strategy To Use For How The Total Loss Of Your Car Is Determined After An Accident

After your lending has actually been settled, any staying cash is yours to maintain (auto insurance). Nonetheless, if the insurance provider's repayment is much less than you owe on the auto, you are responsible for paying the distinction. Choice 2: Leave the Vehicle As-Is In many cases, a totaled cars and truck may still be drivable.

This might be something you would certainly consider if Find more info you don't have collision or comprehensive insurance coverage to pay for repair work. If you decide to maintain driving a totaled car, have it looked into by a mechanic first to make sure it's secure to do so. Choice 3: Keep the Car for Components One more choice if your cars and truck insurance coverage won't spend for repairs is to keep the car and utilize it for spare components.

Otherwise, you can liquidate extra parts that are still in great functioning order to other individuals who possess the very same kind of car. Choice 4: Market It to a Junkyard If you do not intend to undergo the trouble of selling private parts from an amounted to vehicle, you could market it to a junkyard or salvage backyard instead.

Option 5: Contribute the Automobile Donating a completed vehicle to a not-for-profit organization is an additional alternative. There are a variety of charities that accept car donations, consisting of cars and trucks that have actually been completed, to sustain their operations (dui). An added benefit of giving away a completed car to charity is that you might be able to claim it as a tax obligation reduction.

Rumored Buzz on My Car Is Totaled- Will Insurance Pay? - Phoenix Accident ...

If your given away lorry is marketed for even more than $500, you can assert the quantity for which it was offered. To support your tax deduction, make certain to obtain a receipt revealing the date of your contribution as well as the name of the nonprofit company. Some car suppliers will take a completed lorry as a trade-in. perks.